Diligent readers may already be tired of the “active” vs. “index” debate. Then reframe it as the “expensive” vs. “inexpensive” debate when thinking about your own investments. It’s important. As Ben Carlson stated here,

“In the hierarchy of institutional investors you won’t find a more competitive group than college endowments. They’re in constant competition with not only trying to beat the market, but also beat each other. It’s almost like a bizarre finance version of a heated college football or basketball rivalry.”

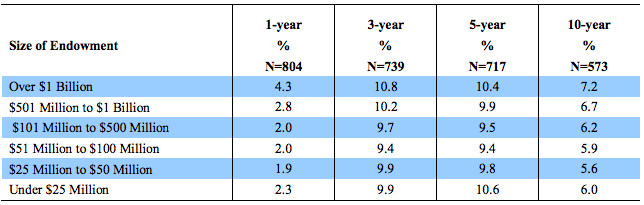

Every year the National Association of College and University Business Officers (NACUBO) puts out a study on the investment performance of college endowment funds. Here’s the latest batch through June 30, 2015:

The study went on to compare 5 year and 10 year results to a “simple index strategy.” Carlson’s blog "names names," but I'm choosing to only make the conceptual point generically. Here are the results:

Size of Endowment | 5 year | 10 year |

Over $1 Billion | 10.4% | 7.2% |

$501 Million to $1 Billion | 9.9% | 6.7% |

$101 Million to $500 Million | 9.5% | 6.2% |

$51 Million to $100 Million | 9.4% | 5.9% |

$25 Million to $50 Million | 9.8% | 5.6% |

Under $25 Million | 10.6% | 6.0% |

Simple Index Strategy | 10.7% | 6.8% |

Source: A Wealth of Common Sense

Carlson went on to state that the total cost of this strategy was 0.19% … i.e. substantially less than 1.0% … yikes!

My views:

I believe much of The Bible was written primarily as poetry. Also, the most modern prayer book I've used recently has what is called ... I did not invent this phrase ... "gender-neutral God language." (When my daughter first heard it, she was thrilled.) The above is actually by way of my apology for the following quote, which is well known but not "gender-neutral." (I tried but the poetry disappeared.)

"For what is a man profited if he shall gain the whole world and lose his own soul?" ... Matthew 16:26

Also ... the Talmudic story, which I found here ...here

"the Talmudic story (Shabbat 31a) in which Hillel, when asked by a prospective convert to Judaism to teach him the whole Torah while he stood on one leg, replied:

‘That which is hateful unto you do not do to your neighbor. This is the whole of the Torah, The rest is commentary. Go forth and study.’"

I have researched individual college endowments. So if any college is already using my idea ... hooray! I also know that the above topic is a source of controversy "inside baseball" ... inside my industry. I'm simplistic. If I were a decider ... especially of a large -- ($1 Billion+) endowment, I would be very tempted to go right down the middle. Keep spending the big bucks for the expensive outside managers and expensive investment management internal staff employed by the University ... for 50% of the funds ... and keep trying to outperform the market. And then spend 0.19% ... again ... yikes! ... on the other 1/2 of the endowment.

What do you think?