"I Don't Know:" The 3 Most Important Words in Investing

"Gundlach lays out what I think are the three most important skills for anyone working in the investment business:

- They have to be analytical.

- They absolutely must have an understanding of human psychology.

- And they have to be able to communicate and explain their views so everyone else — clients and colleagues — understands what it is they’re trying to get across".

Source: Ben Carson in A Wealth of Common Sense

Executive Summary

"I Don't Know" goes perfectly with Diversification. If you think about it just a little, if you "knew" which investment was going to go up the most in the next period of time - monthly, quarter, year, etc. Then you would just put all your investing money into it. Wash, rinse repeat until you are a Gazillionaire!

In actual fact, you (and I) Don't Know. So washing, rinsing and repeating until broke would be the more likely outcome. Some might feel inevitable!

Diversification is Easy! (Until it isn't!) ☹

So why isn't diversification easy? If you're the kind of person who worries, it is your money. Your nest egg. Your future or current retirement. You don't want to lose all or part of it. And sometimes worry might lead us to do things we later regret or otherwise understand to be not in our own best interests.

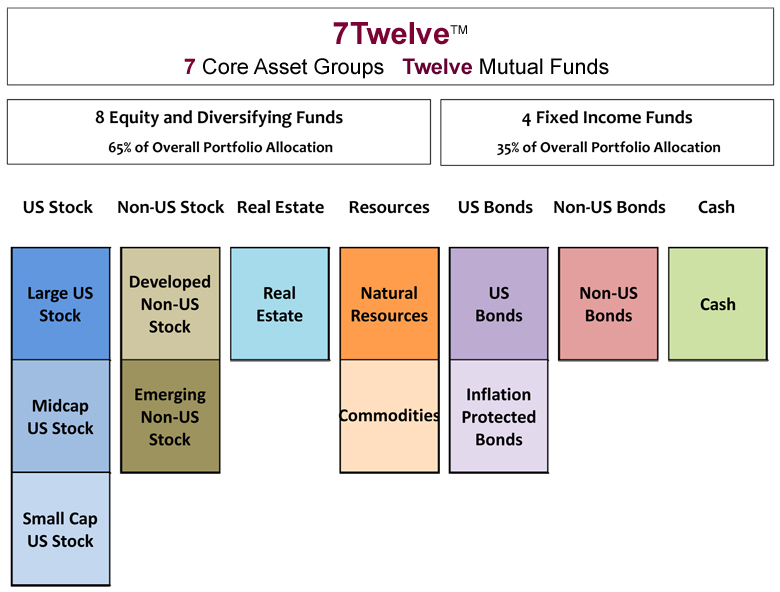

Here's another reason. It can be seen (incorrectly) as too easy. Mechanical. The info about 7Twelve is NOT a recommendation. It is simply one of many approaches. So what's the big deal. It is like a cookbook - a recipe. Find all the ingredients. Put them into the recipe in the right amount. Since this is investing not cooking rebalance periodically to the desired allocations percentages. Retire when you meet your goal. What's wrong with that?

Well, when one part is going through the roof, the all too human psychology is to want more of that. So the temptation is to buy more. Equally or even more difficult, if something else is just in the tank, on the bottom etc., then rebalancing requires you to buy more. But it's not doing well! So you'd rather own less of it, not more.

Maybe this time it really IS different?

OK. Maybe so. Previously I've written about very low interest rates. Lower than they have been in my investing life and many others even older. So, what to do? See also link below.

"A Professional Financial Advisor Should Protect you from making 'Unforced Errors.'"

In the second chart below, many clients would find it impossible to live on the income from a portfolio that is 68.33% cash. What to do. Get a Professional Opinion!

Investors cannot invest directly in indexes. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing. The S&P 500 is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The return and principal value of stocks fluctuate with changes in market conditions. Shares when sold may be worth more or less than their original cost.

The return and principal value of bonds fluctuate with changes in market conditions. If bonds are not held to maturity, they may be worth more or less than their original value. US Government securities are backed by the full faith and credit of the US Government as to the timely payment of principal and interest. The principal value will fluctuate with changes in market conditions. If they are not held to maturity, they may be worth more or less than their original value.

Mutual Funds and Exchange-traded funds are sold only by prospectus. Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained directly from the company or from your financial professional. The prospectus should be read carefully before investing or sending money.

REITs are subject to various risks such as illiquidity and property devaluations based on adverse economic and real estate market conditions and may not be suitable for all investors. A prospectus that discloses all risks, fees and expenses may be obtained directly from the company or from your financial professional. Read the prospectus carefully before investing. This is not a solicitation or offering which can only be made in conjunction with a copy of the prospectus.

Cetera Advisors LLC does not offer direct investments in commodities. A diversified portfolio does not assure a profit or protect against loss in a declining market. All investing involves risk, including the possible loss of principal. There is no assurance that any investment strategy will be successful.