Primary Audience for this post:

- Within 5 years of retirement or closer or already retired.

- Need at least some income from retirement nest egg to maintain standard of living during retirement

Executive Summary

The main thinking about risk must change and adapt over time as an investor transitions into each new stage of goals-based investing. So the investment strategies and portfolio construction decisions aimed at reducing risk must also change and adapt to each new stage. For example, a portfolio for someone who will retire 30 years from now should have different characteristics and attempt to reduce different risks than a portfolio of someone within 5 years of retirement or already retired.

Please also see Redefining Risk attachment.

Initial "conventional wisdom" situation to consider

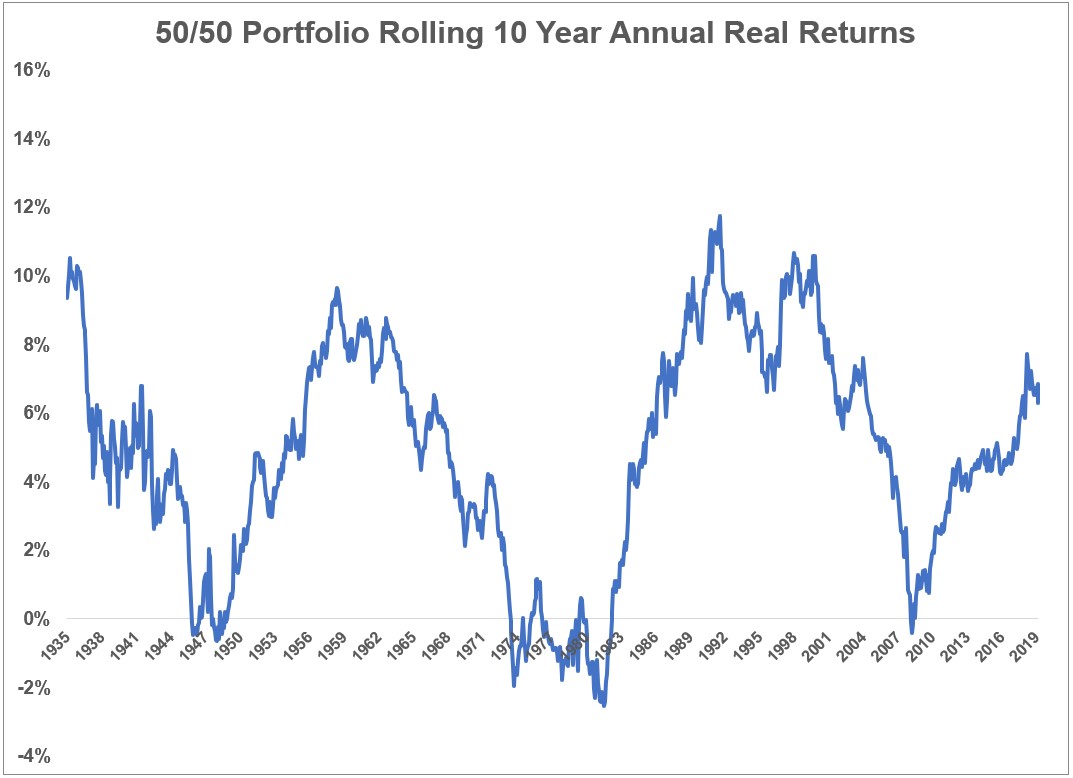

The Conventional Wisdom is still useful for some, but it is possibly being overused or used for the wrong situation at times. In the chart below from Ben Carson, the 50-50 (slightly more conservative than the popular 60-40 portfolio) has rolling 10 year returns that - historically - came back well if you were a young-ish person who had 30 years before retirement. But ....

If you had been within 5 years of retirement in 1974 and needed to generate some income to live on from your retirement nest egg, you likely would hot have been happy with the situation graphed below.

When boomers were younger investors and contributors to our own retirement nest eggs (e.g. 401(k) IRA etc., some might have "overgeneralized" some ideas that might have been more useful then but less useful now. A couple of my nominations:

- Long-term returns will bail us out of short-term market losses.

- A "correct" asset allocation doesn't need to change (much.)

Please also see Ben Carson's excellent post about the success of long-term diversification. If we think about history, an investor who wants to retire 30 or more years in the future can choose to feel "OK" about sticking with a diversified portfolio that has worked well over the long term. So if I happen to be sitting at one of those dips in the chart shown below and if I have a long time before I retire, I can choose to feel OK. If I only have 1-1/2 or 2 years to go before retirement .... not so much.

Source:

https://awealthofcommonsense.com/2020/04/whats-the-worst-case-scenario-for-diversified-portfolios/

Alternative to consider: Goals-based Investing

Investors face different risks for each of the 3 key goals shown directly below:

GOALS

- Growth

- Protection

- Income

Definitions

These are about your time frame and financial status, not strictly your age.

Growth

- You have multiple decades e.g. 20+ years before you wish to retire.

- You have not yet accumulated enough to be able to retire, live off your nest egg, and not work.

- Therefore your main goal is growth of your nest egg.

Protection

- You have some but not a lot of time before you plan to tap your retirement nest egg for income.

- You have accumulated a meaningful retirement nest egg, whether it is already "enough" or well on the way.

- You don't want significant losses at this stage because you might not have enough time for "long-term" results to offset a large loss.

Income aka "Spend"

- You have reached the point where you wish to start spending some of your retirement nest egg now.

- But you still need to generate some return on that nest egg because you want it to last your entire lifetime(s.)

- You can afford very little loss because a loss combined with withdrawals could cause a downward spiral significantly risking your lifetime income goal.

RISKS

- Growth Risk: Volatility

- Protection Risk: Loss of principal (Jargon: "Drawdown")

- Income Risk: Outliving your money (Jargon: "Longevity") ... and .... Inflation

Brief introduction to Outperformance also known as "Beating the Market."

If you "buy an index" (or a proxy) then, theoretically you will match that index (except for "tracking error.") It is, theoretically, impossible to "outperform" OR "underperform" by very much. There are conceptually only a small number of ways to "outperform."

- Buy different securities than the index

- Buy the same securities as the index, but in different amounts than the index holds.

- Simplistically, "switch to cash" at times, either 100% or partially, for example when the portfolio is going down. AKA - also known as - "Timing the Market."

Or, very oversimplified -

- Be a superior "stockpicker."

- Time the market

Some choices on how to implement the above:

- "Fundamental research:" Deeply research and understand the facts of a particular company, its industry and its market.

- Use quantitative algorithms to make ongoing changes to your portfolio.

- Have a static, more conservative portfolio that will outperform only in a down market but underperform in an up market.

- All the other possible choices ...

To the extent practical, some implementation concepts will be covered in a future post

The views stated in this letter are not necessarily the opinion of Cetera Advisors LLC and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results. All investing involves risk, including the possible loss of principal. There is no assurance that any investment strategy will be successful. Investors cannot invest directly in indexes. The performance of any index is not indicative of the performance of any investment and does not take into account the effects of inflation and the fees and expenses associated with investing. A diversified portfolio does not assure a profit or protect against loss in a declining market.